Intro

The Coronavirus brought the world economy to an unprecedented halt, putting a full stop on peoples' lives. Changing the way we go about everyday tasks, it has been nothing short of incredible to observe how something that we cannot see has had worldwide implications.

Finding myself with a surfeit of time, I soon realized that I needed to find pastimes to keep myself occupied. I also noticed that this situation was perfect to start working on myself: having this much free time is truly a blessing and an opportunity that we may not get again. So, I began to read much more: everything from self-improvement to disruptive technologies to investing. I have started this blog to share some of the ideas I've come across - I hope you enjoy.

Close

Blog

Here, you will find my weekly/bi-weekly blog posts archived, in order of the dates they were uploaded.

disciplined pursuit of less

my quarantine reading list

space: it's more than an endless abyss

a new age of investing speculation

the key to extended productivity

the future of finance

artificial intelligence and ethical decisions

i deleted all my social media

Close

About

I am a rising junior at The Johns Hopkins University, currently pursuing a double major in Applied Mathematics and Statistics, along with Economics. I have always had an interest in machine learning and its image recognition and NLP applications, but off late I have started to immerse myself in FinTech. Welcome!

Close

Contact

Close

i deleted all my social media

6/10/20 - FIVE MINUTE READ

We live in an era where technology runs everything around us: we do our work on computers, we interact with our friends and family through our phones, we listen to music through online streaming services. You name it, there’s a good chance that there’s a technology that exists to complete that task. When we live in an age like this, it becomes easy to constantly be bombarded with information. Think about it: when was the last time you simply sat down and did nothing? No, not sitting and staring at your wall while listening to music, and not even eating food. I’m talking about literally nothing. Just sitting there, and doing absolutely nothing. The only thing you do is think. It’s probably been a while right?

The society that we’ve grown accustomed to has intentionally taken control of our minds like this. We’re so used to having information constantly thrown at us, that when it comes to slowing down and just thinking, it seems like a Himalayan task, and I’m no different. I never thought of it as a problem since everyone around me used technology the same amount I did. I thought that to function in our modern world, we have to remain connected at all times and always have access to technology. But I was very wrong.

My social media of choice is Instagram. It’s an all in one package: I get news on what I care about, have my fair share of laughs, see some breathtaking pictures, and stay connected with all of my friends. It seemed ideal, and when I first downloaded it, it was never a problem. I would check it maybe once or twice a day, but that was about it. This was in ninth grade, but my usage habits changed relatively quickly, in about three years time to be specific. Senior year was when my Instagram usage began to spike. I would check it in between classes, first thing when I got to lunch, first thing after my school day was over, I even began checking it in the middle of class when we didn’t have work. What started with Instagram then manifested into other social media platforms: Snapchat, Twitter, Facebook, all of the usual culprits. Naturally with more social media accounts, it took me longer to check all of them. The worst part was that I could never realize how much of a negative impact this was having on my life because everyone around me was using technology in similar ways. People weren’t on social media 24/7, but any chance they had where they didn’t have work or an immediate task to tend to or something grabbing their attention, their natural impulse was to pull out a phone.

To me, my phone usage seemed normal. But recently, I found myself constantly being distracted by it. I picked up an independent study on FinTech that I will be working on throughout the summer, and it’s fairly intense: a 30-40 minute presentation every week with a final paper at the end. When I sat down to begin researching, I got a solid ten minutes of work done, and then began to check my phone. “Ok, I’ll check my messages really quick and then get right back to work,” is the common culprit that sends me down a whirlwind of never ending social media surfing. What started as a quick messages check turned into an hour of going through social media. Somehow I ended up on sports TikToks. Just like that, I had lost an hour of my day. An hour that I could have spent researching, an hour I could have spent reading, an hour I could have spent doing anything that wasn’t watching TikToks. But this was a common occurrence for me. Tasks that should take an hour took me a whole day to complete, all because of that stupid 5.8 inch rectangle sitting by my side at every waking minute of my day. I slowly began to realize how much of an issue this was. I could be getting so much more work done in a much more efficient manner, but my phone was preventing me from focusing on one task for an extended period of time. This is a common issue in our society today.

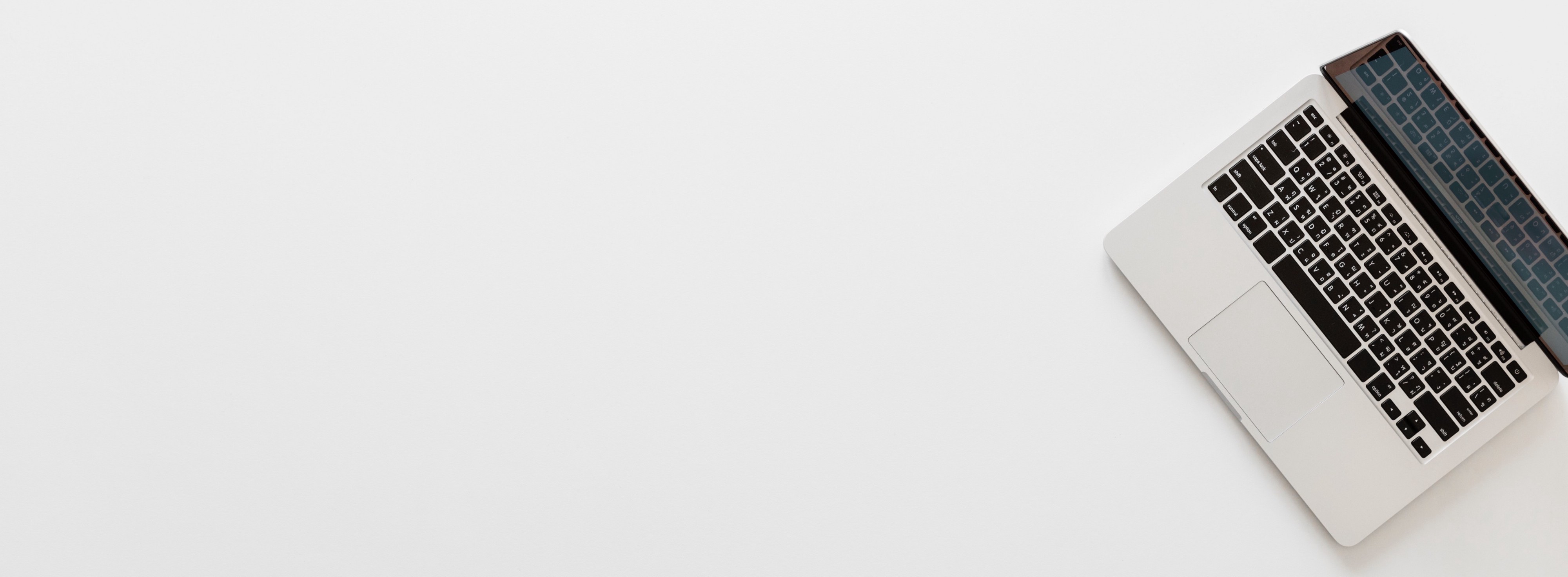

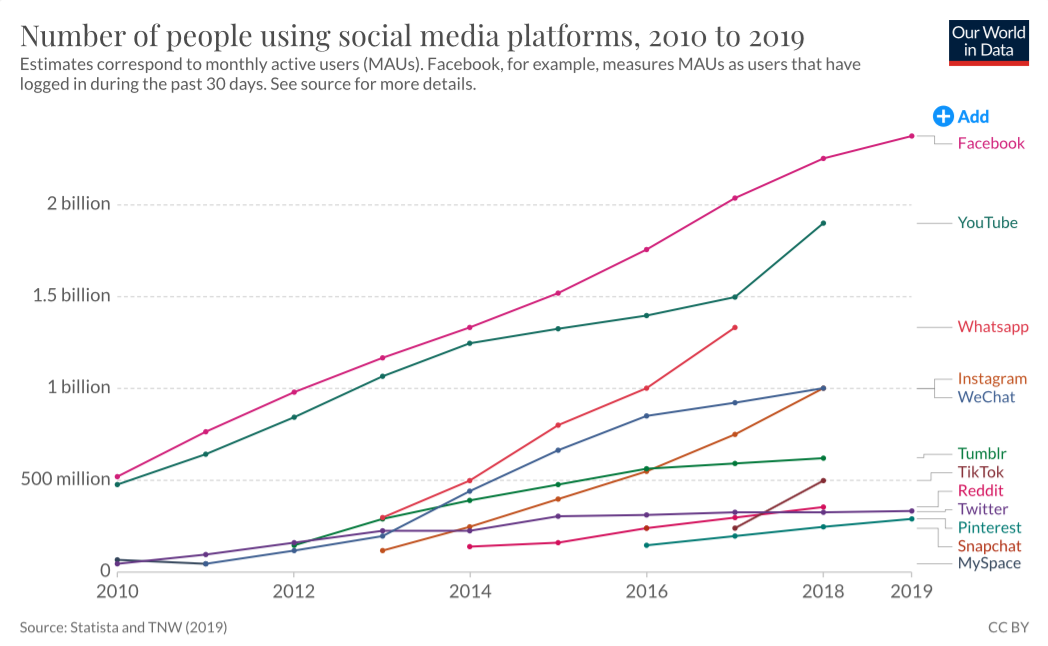

Social media has grown to extents that were unimaginable a few years ago. It’s hard to find someone who does not have SOME form of social media. In ten years, the amount of Facebook users has quadrupled, Twitter users have increased nearly eight fold, and since 2013, Instagram’s user base has increased nearly nine fold. And this is a trend that does not seem to be slowing down anytime soon. As our world becomes more connected and impoverished countries gain access to high speed internet and smartphones, the growth in users of these platforms is accelerating. Surely enough, with more social media users, more individuals grow victim to technology’s detrimental effects.

Now look, I’m not some guy who hates everything about technology and thinks it should all be banished and we should return to how we were in the Stone Ages. Technology has done wonders in terms of our advancement as a species and has had countless positive impacts on our society. But, I personally believe that some technologies have more detrimental effects than intended. It is so difficult for us to focus on one task at a time, and put our all into one effort. Because of technologies like social media, easy access to streaming videos, the ability to “connect” (I put connect in quotes for a reason, I’ll return to this) with others, we’re so used to always doing something. Our attention is constantly seeked; in this age, attention is money. Every big tech company makes money through our attention: the more time we spend on these platforms, the more money they make. The mission statement of most social media boils down to something along the lines of enabling us to stay connected with each other. This is true, but it’s not their real intention. They want nothing more than to reel you in and for you to use their platform for hours on end, and they’re damn good at it. These apps have all been designed with ease of use in mind: sleek user interfaces, low learning curves, simple content posting and receiving, all to do one thing: grab your attention and keep you wanting more. It’s safe to say that they’ve accomplished that goal pretty well.

So when I finally realized all of this, I decided to make some drastic changes in my life in terms of technology. Recently, I deleted all social media apps on my phone, including YouTube. I’ve tried this before, and I was able to delete Snapchat, Twitter, and Facebook with ease, but I have always had trouble deleting Instagram. It felt like such a vital part of my life. Sure enough after I deleted it, I was checking my phone every five minutes, and was tapping an empty part of my screen where Instagram once was. It was eye opening: I only realized the extent of my addiction once what I had was gone. Over time, it became much easier to deal with, and eventually I got to a point where I wasn’t compulsively checking my phone looking for updates.

The benefits began to show quickly. Within a week, I was already accustomed to my social media absent life, and I didn’t feel like I was missing out on anything. My average daily screen time went from eight hours (yes, eight hours) to around two. I honestly felt free; I could finally focus on one task for hours at a time without having my concentration broken by a notification.

For me, digital minimalism consisted mainly of getting rid of social media, since that’s where I spent the majority of my time, but it can take many forms. Cal Newport’s book Digital Minimalism is a great read that I highly recommend, and it doesn’t take long to finish. Newport highlights the extreme forms of digital minimalism, where you can get rid of everything digital in your life, and then slowly begin to reintroduce them as you see fit, analyzing whether it’s really necessary for you to have that technology present. That way, you see which technologies are truly essential in your life and only use those. Personally, this extreme wasn’t for me, but it may be worth trying one day just for fun.

Social media and technology in general make us feel as though we need to constantly be connected with people. We worry that if we’re not reachable every minute of the day, we’ll miss something important and the world will end. But in reality, nothing changes. The world will not stop spinning, you won’t die, and everything continues. To be honest, it doesn’t seem like many people even noticed that I’m off social media. I can count on one hand the number of people who have asked me about it. It goes to show that these social media really don’t “connect” us. We gain this false feeling of connection through mindless actions such as likes or shares when in reality, that’s not connecting at all. Connection is seeing someone in person, having an enriching conversation, and feeling like you truly gained something from an interaction. I can confidently say that I’ve become much more appreciative of the smaller things around me. Things like spending time with family, joking with friends, reading a book, are all so much more fulfilling without the constant worry of having to check my phone.

Give it a try for a few weeks. See if it’s your style, and if not, you can happily go back to your ways of prior phone usage. I’m not one to judge considering I’ve been there. But if you want to try it out, two great places to start are by deleting all your social media, and then reading Cal Newport’s Digital Minimalism. Now if you’ll excuse me, I need to redownload Instagram to share this blog.

Close

artificial intelligence and ethical decisions

6/17/20 - FOUR MINUTE READ

Allow me to posit a scenario: you are driving down the road in your newly purchased Tesla Model S, enamored by the finesse of the autopilot feature. It’s like you’re in a movie: your hands are off the steering wheels, you sit back and relax as the car’s eight cameras and twelve ultrasonic sensors seamlessly execute millions of computations on a seconds notice, and then all of a sudden, a group of five people appears in front of you. You have no time to hit the brakes or take control of the car, and the autopilot now decides your fate as it is faced with two choices: immediately turn the car, saving the group of individuals but killing you, or save you, but proceed to claim the lives of those in front of you. How does it make a decision?

This is an extreme scenario, but it brings to light a very pertinent question, especially in our technological age: can artificial intelligence and machine learning make decisions based on ethical judgments? Elon Musk is one of the most vocal influencers on this topic, stating that artificial intelligence is, “The biggest risk we face as a civilization.” This is a common concern throughout our society - the fear that autonomous AI will make humans obsolete, along with the worry that AI will eventually revolt and exist independently of human guidance. Though this is something we will definitely have to worry about, I don’t think it should be a concern in our near future.

We have to remember something very important: AI is only as good as the data it is given. Our human ethics are not generally something that can be quantified and turned into data. Ethics are something humans feel rather than intellectualize, and it would be very difficult to train that feeling into a model. A perfect example is Microsoft’s Tay, a Twitter chatbot that was designed to learn from interactions with other humans on Twitter. Soon after its inception, the algorithm was taken advantage of, as trolls from 4chan fed it bad data and turned it into a racist and foul-mouthed bot. This proves two things: first, it emphasizes my earlier point of AI being as good as the data it’s given, and second, at this point in time, it is not feasible to program every possible ethical behavior. We can program a few, but it’s inevitable that we would miss some here and there.

So what does this all mean? For now, it does not seem possible for artificial intelligence to make decisions based on ethical judgments. The technology doesn’t allow for it, and it just does not seem reasonable to be able to program every single human feeling. But, that doesn’t mean that AI cannot provide us with the information we need for better ethical decision making.

Andrew McAfee and Erik Brynjolfsson’s book Machine, Platform, Crowd: Harnessing our Digital Future discusses how three essential aspects of the digital revolution are being rebalanced to have massive implications on how our businesses are run and how we live our lives. One of these aspects is the rebalancing between minds and machines. Humans reason in two different ways, which in the book are classified as System 1 and System 2. System 1 reasoning is, “fast, automatic, evolutionarily ancient, and requires little effort.” It’s what we know as intuition. System 2, on the other hand, is the opposite: “slow, conscious, evolutionarily recent, and a lot of work.” Both systems can be improved over time, as System 1 would be improved naturally and broadly through life experiences, and System 2 would be improved through taking a math or logic course.

Now, you may be wondering what this all has to do with AI and making ethically rooted decisions. Several studies were done essentially comparing the judgment of experienced, “expert” humans with that of a 100% data-driven approach. A team led by psychologist William Grove went through 50 years of literature looking for published, peer-reviewed examples of head to head comparisons of clinical and statistical prediction like this, and what they found was astounding. In 48% of the studies, there was no significant difference between the two, so the experts were on average no better than the formulae. However, in 46% of the studies, human experts actually performed significantly worse than the numbers and formulae alone, leaving 6% of cases where humans were superior to algorithms. And in this 6% of cases, authors concluded that “clinicians received more data than the mechanical prediction.” Paul Meehl describes it best: “When you are pushing over 100 investigations, predicting everything from the outcome of football games to the diagnosis of liver disease and when you can hardly come up with a half dozen studies showing even a weak tendency in favor of the clinician, it is time to draw a practical conclusion.” That practical conclusion is the fact that human judgment is clearly being beaten out by these machines.

It may be hard to believe but it’s true, and it makes sense if we start to think about it. Humans for the most part use both System 1 and System 2 in making decisions. Daniel Kahneman, author of Thinking, Fast and Slow, who created this dual system of thinking states that, “System 1 thinking operates automatically and cannot be turned off at will, errors of thought are often difficult to prevent. Biases cannot always be avoided, because System 2 may have no clue to the error.” All this is saying is that we have biases within us that we essentially have no control over. Though we can try to acknowledge them and try our best to ensure that they do not affect our decision making, there will always be some bias present.

So what can we do about this? It’s simple: many decisions, judgments, and forecasts that are now made by humans should be turned over to algorithms. But, people should still remain in the loop to provide commonsense checks. It returns to the idea that some things, as of right now, cannot be programmed and human ethics is one of those. The evidence is clearly overwhelming though that whenever the option is available, which in this case are decisions not rooted in ethics, relying on data and algorithms alone usually leads to better choices and forecasts than relying on the judgment of so-called “experts.”

But algorithms are far from perfect. As mentioned before, if they are based on inaccurate or biased data, they will make inaccurate or biased decisions. A prime example of this is IBM’s Watson for Oncology. The project was overseen by a small, highly respected medical team (one may call them “experts”). But, it developed a very American-based view of cancer diagnostic treatment that was not scalable to other parts of the world. This shows how algorithms can look great on the surface and if tested on the right set of data, can seem as though they are efficiently completing their job. But when tested across larger pools of data, clear issues arise, and we begin to see why humans are needed to guide AI on an ethical basis. Most bias is unwitting, so working in large, diverse teams, will ensure that AI is being trained on the right set of information, while also acknowledging limitations of said data.

So, the day may eventually come where AI takes over humans. Maybe the storylines of video games like Detroit: Become Human or movies like I, Robot can come true. But today, it just doesn’t seem reasonable. We shouldn’t isolate minds or machines: it’s important that we work in tandem with these algorithms to produce the most accurate, bias-free results possible to lead better lives in the future.

Close

the future of finance

6/24/20 - FIVE MINUTE READ

Finance. It’s an umbrella term that encapsulates a wide range of focus areas: corporate finance, investment banking, venture capital, accounting, insurance, the list goes on and on. It becomes easy to get lost in all of the Wall Street jargon and feel completely lost. Don’t worry, I’m not here to throw more confusing terms at you. What I am here to talk about is a revolution happening right in front of our eyes that many have not noticed, and is changing the way our world works. I’m not exaggerating when I say it’s changing our world, it truly is that big.

That revolution is FinTech.

FinTech is short for financial technology, and it is an industry encompassing any technology in financial services. It describes any company offering a financial service through a means of software or other technology, and it is as broad as finance itself, covering everything from mobile payment apps to cryptocurrency to insurtech. It seems like a simple concept, but don’t let that fool you. FinTech has brought about some of the most notable disruptions in the past decade alone. This summer, I have had and continue to have the privilege of working with Dr. Jim Liew from the Johns Hopkins University Carey Business School to analyze the disruptive nature of nine different FinTechs and their impacts on incumbents in their respective fields. From the industries I have analyzed so far, I believe that FinTech is disruptive for three key reasons: it is addressing the unmet needs of consumers by filling in gaps, democratizing different aspects of finance, and simplifying seemingly complicated financial concepts.

1. Addressing unmet needs

The most well-known disruptions arise from addressing unmet consumer needs: smartphones enabled users to access the Internet from practically anywhere, e-commerce allowed consumers to quickly and easily purchase goods, web-based streaming services made watching videos and listening to music possible from anywhere, I think you get the point. FinTech is no different in this regard. Many examples of FinTech look to tap into markets where consumers’ needs are not met.

One of the best examples of this is the rise in alternative lending platforms. Alternative lending is any lending practice that happens outside of a traditional banking institution. It’s also commonly known as peer 2 peer lending since loans are fulfilled by other individuals, not an institutional investor or incumbent bank. The first major alternative lenders that came into play were Prosper and LendingClub, created in 2005 and 2007 respectively. After the financial crisis of 2008, funding for small business dropped significantly. Data from the FDIC shows that the proportion of commercial and industrial loans less than one million dollars, which is the standard used to assess small business loans, has fallen to 21% from 34% prior to the financial crisis. This crunch in lending has not only affected small businesses, but also individual consumers, especially those in lower tax brackets (below 30%). So, a new breed of lenders emerged to address the gap between small business/individual consumers’ needs for financing and the willingness and capacity of banks to serve them effectively. These FinTech firms pioneered a distinctive online and digital-based approach that promised to greatly enhance small business access and efficiency to funding for growth using a method of debt financing enabling individuals to borrow and lend money without the use of an official financial institution as an intermediary.

This idea, though simple, was and is a game-changer. In April 2019, alternative lenders had the most funding across different FinTech startups, at $639 million, and the industry has grown exponentially. Prosper offers fixed-term loans between $2,000 and $40,000, and since its inception in 2005 has facilitated more than $17 billion in loans to more than one million people.

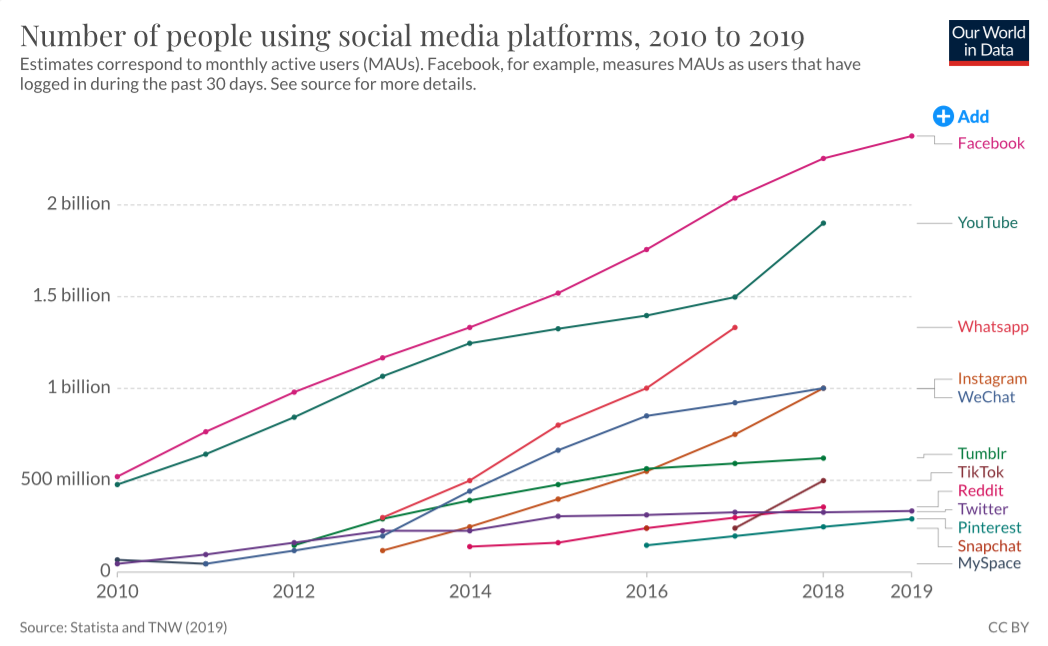

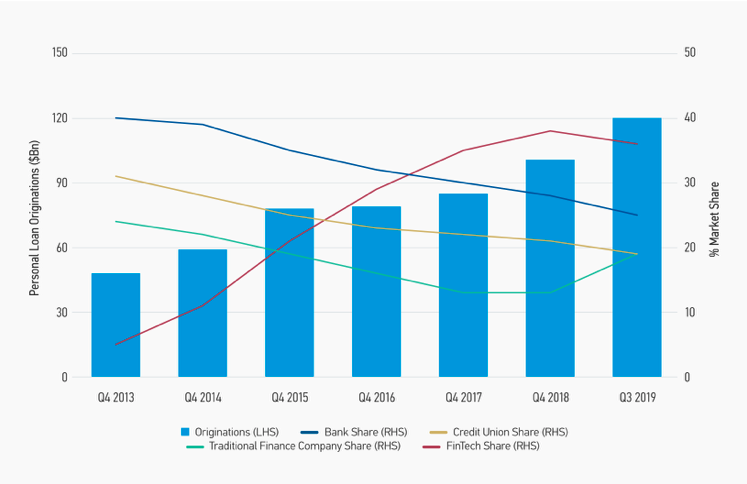

This diagram from Morgan Stanley shows the amounts of personal loans given out over the past seven years and the sources from which they originated. FinTech firms (the red line) have not only increased the percentage of the market they appeal to, but they seem to even be stealing some market share from other traditional lenders. It becomes easy to see how disruptive these alternative lenders are to traditional financial institutions, and this is the story across many FinTechs. Market share is starting to shift towards them because they are able to offer a service that was previously unavailable, typically in an economically efficient and reliable manner.

2. Democratizing different aspects of finance

Some parts of finance have typically been tailored towards very specific audiences, whether that be the wealthy, or people willing to pay thousands of dollars for a piece of equipment. With the wide range of FinTech firms available, many areas that have traditionally been available only to a select group of people are now accessible to the average individual.

One area of finance that was specifically tailored towards the wealthy is wealth management. Wealth management is an investment advisory service that combines other financial services, such as investment guidance, estate planning, retirement planning, and more, to address the needs of clients. The idea behind wealth management is that rather than trying to integrate different advice from different individuals, individuals benefit from a holistic approach where a single manager coordinates all of the services needed to manage a person’s money and plan for a family’s current and future needs. However, it has always been tailored to the wealthy. For example, Fidelity’s private wealth management service requires at least $2 million invested through Fidelity Wealth Services and $10 million or more in total investable assets.

These are minimums that are not applicable to your average individual. So, companies like Wealthfront and Betterment were created to allow regular people to have access to services like ones that wealth managers offered. Both companies allow you to put your money into an account, and based on your risk tolerance (which is determined through a few questions) creates a portfolio allocation across stocks, bonds, foreign exchange, and more. You can elect to put your money in a taxable account, retirement account, or 529 among other options.

Developments like this are huge. These companies are democratizing access to services that were typically provided by wealth managers for exorbitant fees. Betterment has no minimum amount required to invest, and Wealthfront has a $500 minimum, much more affordable than $2 million. The most important thing to consider here is that they are not sacrificing much, and the service they are offering is practically the same that a wealth manager offers. You may immediately think that since they are offering a valuable service for cheaper, then they are getting rid of key aspects of wealth management. At the end of the day, the service that they are offering is basically the same, and even superior in some regards. These online wealth management services invest money automatically and continue to automatically rebalance portfolios to sustain the risk tolerance of the individual, which is a process that would typically take much longer than a few minutes with a traditional wealth manager.

This is a common trend among FinTechs that are causing major disruption. Another prime example is in stock market investing. With the rise of the Internet and affordable online brokerages, access to real-time stock market information, which was typically only available to brokers and traders, became available to anyone who had an Internet connection. This ability to democratize different aspects of finance is so effective in causing disruption because it allows companies to harness untapped segments of the market who previously could not utilize certain financial services due to their hierarchical nature.

3. Simplification

One of the most important ways that FinTech has been so disruptive is in its ability to empower individuals to do more. Like I mentioned at the beginning of this post, there is so much financial jargon that it all becomes a blur after a certain point. Many FinTech companies are now enabling and empowering individuals to achieve things they couldn’t before through simplicity.

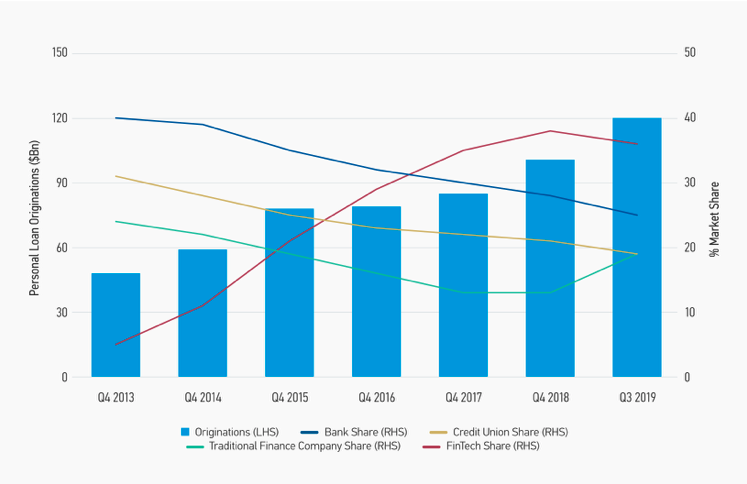

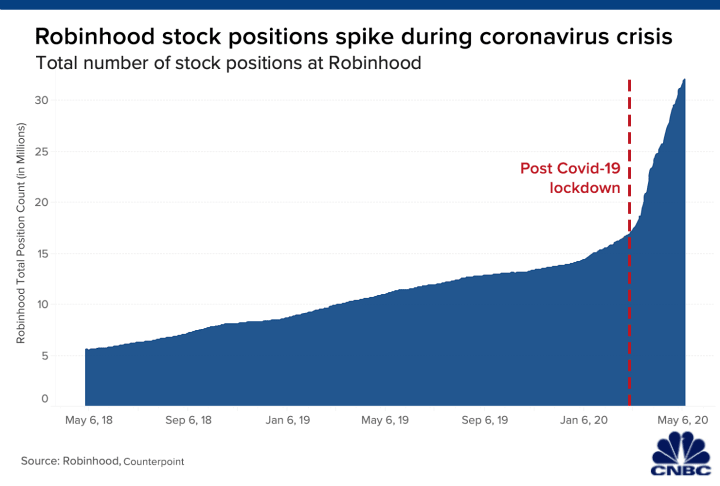

A great example of this is Robinhood. Robinhood is arguably one of the most famous finance-related apps right now; it is a free trading app allowing investors to trade stocks, options, ETFs, and cryptocurrencies without paying commissions or fees. They were truly disruptive when they first came out, as they were the first broker ever to offer trading without commissions or fees. Their existence forced all other brokers to follow suit and eliminate all commissions and fees. Robinhood is known for its simple platform: the app has news, a line graph showing the value of your portfolio, and the ability to execute trades. That’s about it. There’s really not much more than that, but that is what has ushered in a new age of investors that previously never invested. A Harris poll found that 80% of millennials are not investing in stocks because they believe that it requires a great deal of money and knowledge to begin. With an app like Robinhood that dumbs everything down, it becomes very easy for a beginner to get started in the market. Granted, it’s important to note that there is a fine line between arming users with the ability to trade easily and promoting detrimental activities, but that’s a topic for another post.

Simplicity is at the heart of many disruptive technologies. Autonomous vehicles simplify driving, artificial intelligence makes various tasks easier, and FinTech is no different. Most examples of FinTech take traditional financial practices that tend to be resource-intensive and make them much more efficient and easier to work with, allowing more people to gain exposure to and use these services.

All in all, FinTech is around us everywhere, and it’s here to stay. Chances are if you need to do something finance-related on a whim, you will be using FinTech. There’s a good chance that you’ve been making use of apps like Venmo or Coinbase without realizing that you’re part of a revolution. It is only going to grow from here, and I can’t wait to see what disruptions it brings about next.

Close

the key to extended productivity

7/1/20 - SIX MINUTE READ

It happens to the best of us: you suddenly have a realization that the path you’re going on will take you nowhere in life so the next day, you wake up more motivated than ever to accomplish everything you have planned for the day. You finish one day of work and feel great, and move on to the next, and the next, and the next. But after a few days, you burn out and fall into a rut, getting absolutely nothing done, going backward while binging Netflix and eating junk food. Eventually, you decide you need to get your act together and set ambitious goals for yourself. And the cycle repeats: periods of uber productivity and periods of absolutely no work. Two extremes with no balance of both.

A common reason attributed to this lifestyle is the idea of our “hustle culture.” This is something I hear a lot, where people believe we have to be working 24/7 and constantly busy to accomplish things in life. Though this is certainly a factor as to why this cycle exists, I don’t think it is the primary reason. Moreover, I firmly believe the primary reason for this cycle is because we as humans are horrible at determining how much work to take on. Naturally, humans are terrible at planning and poor judges of how long things will actually take. A perfect example of this is underestimating how much time it will take to get from point A to point B. “I’ll be there in ten minutes,” really means they’ll be there in an hour. So, since we underestimate how long things will truly take to finish, we start to pile on work. We start to take on projects because of our initial passion for them, but when we begin to realize how long that project will really take, our interest wanes, and in the end, we’re left with something that we’re half-assing without any real motivation to finish.

This has happened to me multiple times. I have so many songs that I’ll start because of an idea in my head, but when I realize how it isn’t coming together as I wanted, I’ll either give up or finish it in a rush and end up with a horrible final product. The reason this leads to the cycle I explained before is because in that period where we lose interest in our current project, something else catches our attention, and we begin to pursue that with the same motivation and fervor as the previous project. But soon, our interest in that dies out and we find something else, and the cycle continues. We reach a point where we have all of these pursuits stacked up and complete not a single one with that initial passion, so we lose confidence and fall into a rut.

Obviously, the best way to go about this issue is to have a better filter on which projects and work you pick up. Pursue only those projects that you know you can see through to the end, and choose two or three of them. Delve into them with a depth you never have before, and you will not only notice that it doesn’t feel like work since you truly enjoy it, but your final product will be much better. Plus, you’ll have more time to relax so you won’t get caught in the cycle of extremes.

That’s great and all, but if you’re like me, you may already only have a few things on your plate, but they take up the majority of your time. Currently, I have three big projects I’m working on at once, and when I’m not doing that, I’m either working to make money, eating, or sleeping. So even though I’m only working on a few projects, it still becomes hard to find time in my day to get away from the work to pursue some of my hobbies and favorite pastimes, and I start to face the burnout issue.

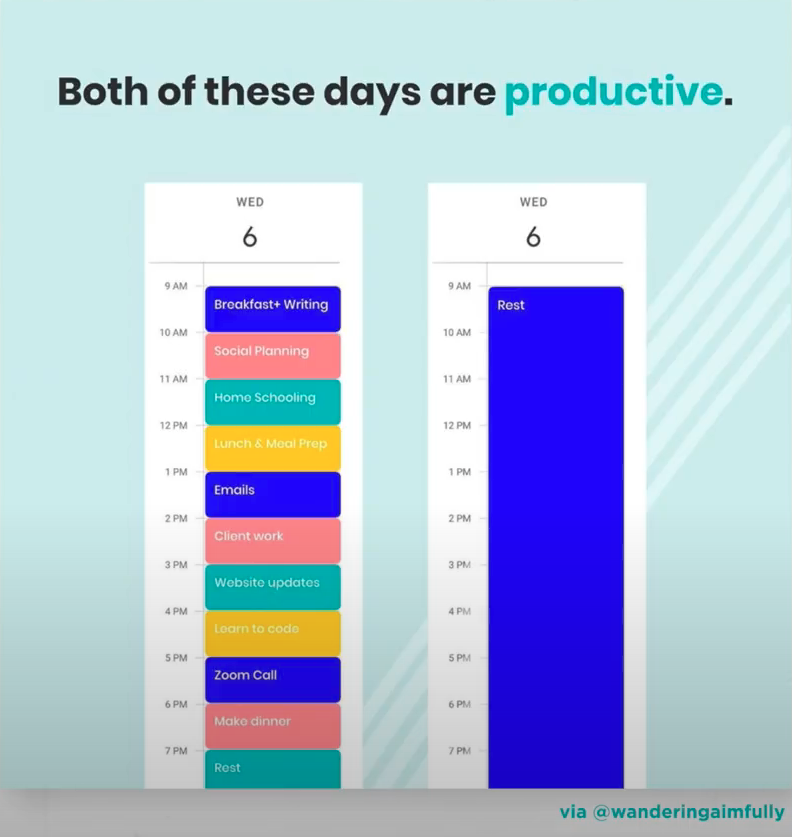

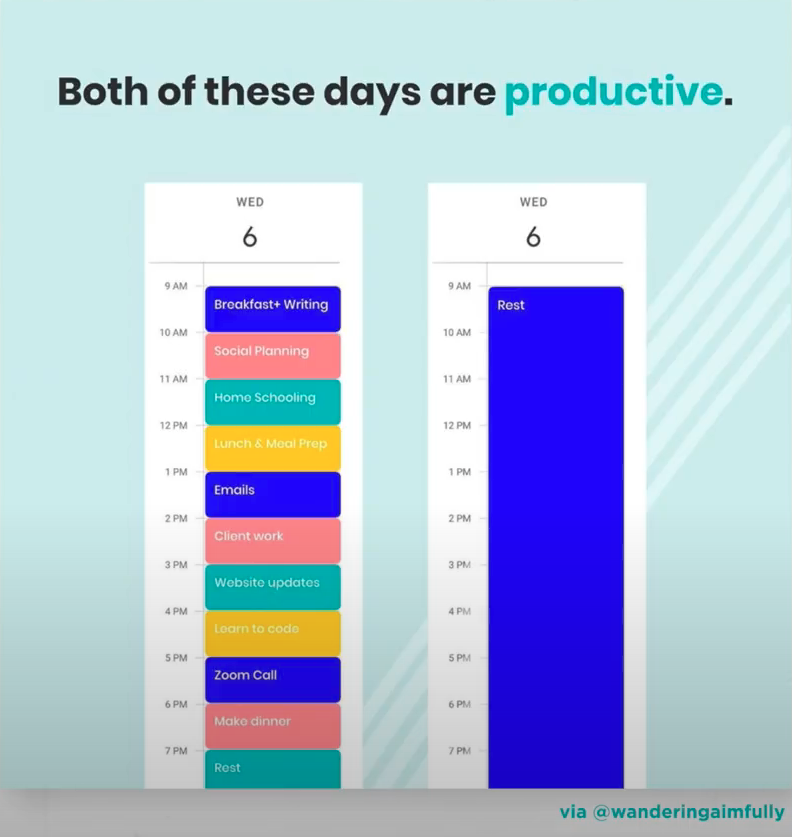

Rest needs to be taken as seriously as everything else when it comes to your productivity. This may seem obvious, yet so few seem to practice it. When it comes to rest, it needs to be done in a proactive and efficient manner. So in the coming paragraphs, if you expect me to tell you to take an hour in your day to watch TV, you’re in the wrong place.

My favorite way of incorporating rest is through creating boundaries in three primary ways: for your days, weeks, and months.

Days

The best way to go about this is by setting boundaries on when you start and end your days. The average college student’s workday goes from 9 AM to maybe 3 AM if they’re lucky. After a certain point, it catches up to you and you become more lethargic, and it becomes a downward spiral. But it doesn’t have to be this way. Cal Newport’s book, Deep Work, does a great job explaining this concept. In the book, Newport explains how in today’s society, one of the most valuable skills to possess is the ability to sit down for a certain period of time and focus solely on one task. No distractions, no breaks, just working. He provides many examples in the book of people who were able to fulfill great goals by following this “deep work” idea. It’s so simple, but it’s so effective. By sitting down for two hours and working on one task with all your concentration, you can get work done that would typically take a day.

When you use this method of working, you then begin to have more time in your day. You’ll begin to notice that you’re getting more work done and have more time available, and you can start to set boundaries on your day. In the book, Newport also explains the importance of rest. One of the many things that I picked up from the book was how Newport ends his days. At the end of his workday, which is typically some time in the early evening, he initiates what he calls his “shutdown sequence.” When he is done with his work for the day, he will look at everything he has done, double-check and make sure that he has completed everything he needs to for the day, and ensures that nothing will come up later that he will need to tend to. After this, he is done with work for the day for good. He doesn’t think about anything work-related: this is the most important part. If you want to rest efficiently, it’s so important that in the time you’re resting, you really rest. You shouldn’t have the paper that’s due tomorrow or an unattended email on your mind. Believe it or not, these small thoughts can have significant impacts on your productivity the next day. So, set boundaries on your workday. Know when you want to start, make the most of your time working, set a hard time on when to stop, and stick with it. You’ll quickly begin to notice the productivity boosts as your days don’t seem nearly as much of a drag or as strenuous.

Weeks

The most important part of weekly boundaries is respecting your weekends. It’s so easy to tell yourself that you’re only going to write one paragraph on Saturday or check a few emails on a Sunday, but that quickly begins to turn into a seven-day workweek. There’s no quicker way to burn out and lose your passion for something than by doing this, and it returns to the previous point I made about how important it is to really rest when you’re resting.

Your weekends should be a time to recharge and get ready for the hard week ahead. This is time that should be spent doing things you truly love, and not time spent thinking about your obligations. Remember, those should have been handled during the week through the time you spent in deep work. I highly recommend against whiling away hours in front of a TV or playing video games for hours on end, because you come out of these sluggish, lethargic, and unmotivated to do any work. Spend quality time with friends and family, read a good book, try something new that you have always wanted to. That way, you’re not only resting, but you’re coming out of your rest feeling great and ready to take on the coming week. There are obviously exceptions to this rule, such as if it’s finals week at college. I understand how much content there is and how much time students spend studying, and this is one of the few times I would not take a weekend to relax. But otherwise, weekly boundaries ultimately have the same effect as daily boundaries, just on a larger scale. You’re taking two days off to set yourself up for five days of work, rather than taking a few hours off to set yourself up for the next day of work.

Months

Monthly boundaries are definitely the most overlooked type of breaks because they are not naturally baked into our typical routines. In my eyes, they’re kind of like a bonus that if you can incorporate them, will do wonders for your productivity, but you can still achieve great results without them. These are longer breaks that you take on a monthly or bi-monthly basis. Most of us work throughout the week and have weekends off (to some extent), but not many of us take the time to truly step back from our lives and reset. These monthly breaks are a few days where you get away and escape, and detach from everything: from your work, your life, your problems, everything.

And no, this break does not consist of jumping off boats or traversing across Machu Picchu. It's meant to be a calm reset, where you should be getting away from your home, city, and office. This will not only ensure that you don’t do any work, but it reduces the chance of work sneaking into your mind. For some of you that may live in the city or an active suburb, this will also be a great chance to get away from the busyness that comes with living in a bustling location and give you a chance to appreciate nature. Another key part of these breaks is limiting screen time, so yes, this means no social media. Apart from maybe a Kindle or listening to podcasts, I would highly recommend not using your screen at all. There’s a beautiful essence in disconnecting from the world and not worrying about everything that’s happening. It allows you to slow down and start to appreciate all of the smaller things around you. Finally, and the most important, is to leave your work at home. Your ego tricks you into the importance of your work, and it makes you feel like you’re going to miss out on something. This returns to the idea of our “hustle culture,” that I introduced before. During these trips, it’s key that you do not do anything work-related, as it will allow you to get a real break. Obviously, before going on one of these breaks, it’s imperative that you make sure all of your work is completed and that you can afford a break for a few days, but after getting all of that together, you shouldn’t touch or think about work for those days. In these times, of course, it is difficult to take trips like this because of all of the imposed restrictions, but hopefully, they will be lifted in a reasonably short amount of time.

If there’s one thing that this pandemic has taught me, it’s the importance of rest. Especially near the beginning of the lockdowns when I had so much time, I didn’t know what to do, so I began to pile on work to take up all of the time in my day, and I was caught in a cycle of super productivity and absolute burn out. As I began to set boundaries on my days and weeks, I found myself enjoying my work much more and also getting much more done. I hope you can use this simple system to your advantage to help boost your productivity efficiently.

Shutdown sequence initiated.

Close

a new age of investing speculation

7/8/20 - FIVE MINUTE READ

The stock market is currently going haywire, to say the least. We’re seeing stocks hit record highs, inflated P/E ratios, and the disconnect between reality and the market has never been more disparate. It doesn’t take an expert to realize how overvalued stocks are. How did we get here? Where will we go from here? To look forward, we first need to look backward and understand where we came from in terms of stock investing.

Investing in the 1950s was a nightmare, as the process was much more time consuming and expensive. Fixed commissions were the norm, and limited competition meant that these commissions were quite high and non-negotiable. The limitations of technology meant that the execution of stock trades, from initial contact between an investor and a broker to the time the trade ticket was created and executed, took a considerable amount of time. Furthermore, investment choices in the 1950s were also limited, since the mutual fund boom was still years away and the concept of overseas investing was non-existent.

Then, the 21st century came around. Investing is now a much easier process than it was in earlier decades, as investors have the capability to trade esoteric securities in faraway markets with the click of a mouse. A number of developments over the past two decades have contributed to the new investing paradigm, but the proliferation of economical personal computers and the Internet had the biggest impacts, as they made it possible for almost any investor to take control of daily investing. The popularity of online brokerages enabled investors to pay lower commissions on trades than they would have paid at a full-service brokerage, lower commissions facilitated more rapid trading, and in some instances, has led to individuals pursuing day trading as a full-time occupation.

So, in this new connected world that we live in, practically anyone can become a day trader or can learn to speculate. No, I did not mean invest, I meant speculate. We’ll get to that later. This now brings us to our current situation. I believe that the current market is propped up on excessive government stimulation and unreasonable future outlooks.

When we look at the fluctuations in prices that have occurred in the past few months, a commonly attributed reason is the sudden influx of new speculators. Though there has been a sharp rise in the number of new speculators (record numbers of accounts are being opened at brokerages like Charles Schwab and E-Trade), they don’t have that level of influence. I’ve repeatedly heard people say that the turnaround in markets has been due to new speculators entering the market and funneling in money, or people putting in money now due to FOMO (which is the worst thing you could do), but these individuals do not have that much of an impact on the market, and here’s why.

If we look at who owns stocks in America, only 51.9% of families in America own stocks. Of these, 87.8% who held stock did so in a tax-deferred retirement account, which means that most of these people probably don’t touch their stocks after they put their money in these accounts since they want long term sustained growth. So, only 26.9% owned individual shares of stock, while 18.9% invested in a “pooled investment fund,” like an index or mutual fund. What’s even more shocking is that 84% of all stocks owned by Americans belong to the wealthiest 10% of households. And that includes everyone’s stakes in pension plans, 401(k)’s and individual retirement accounts, in addition to trust funds, mutual funds, and college savings programs like 529 plans. Let that sink in for a minute. Do you really still believe that the average Joe who buys 1/4 of a Tesla share is going to drive the market up or down?

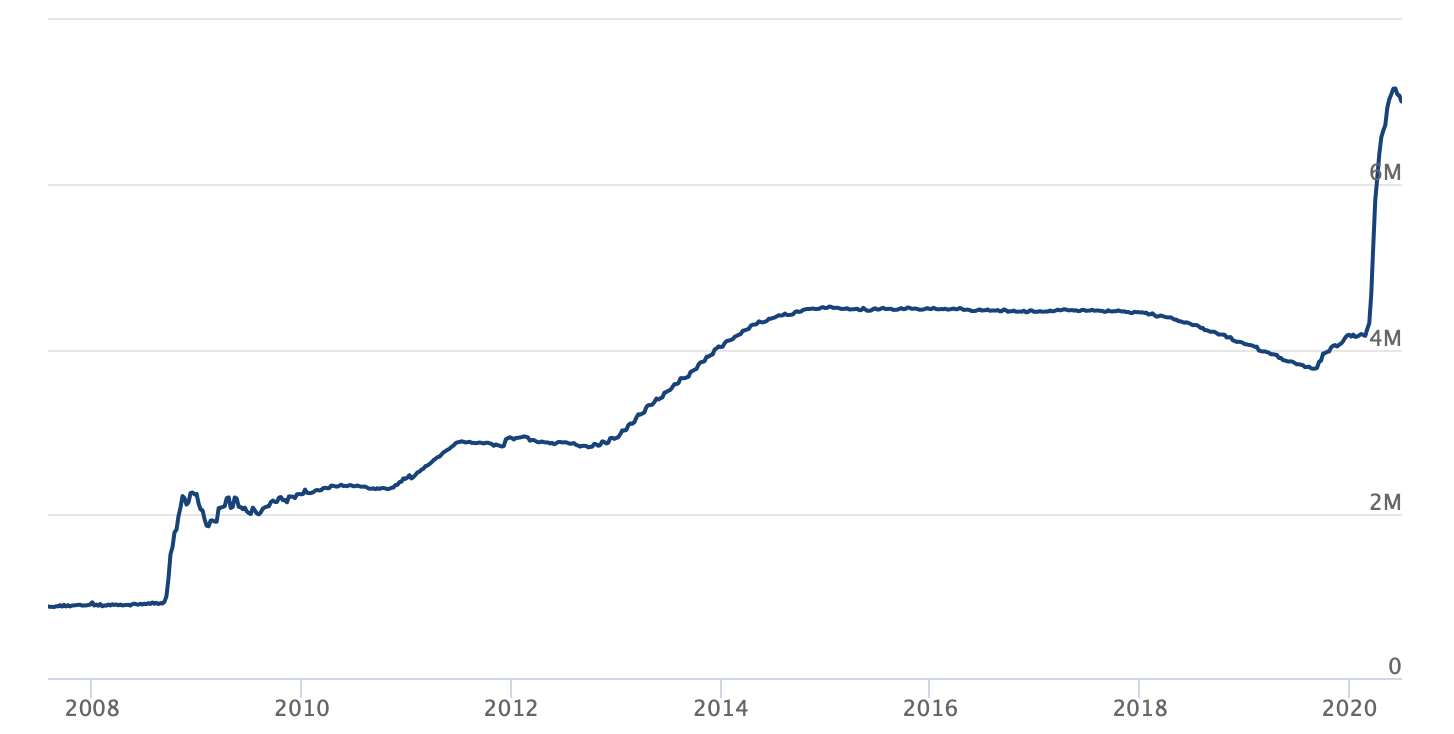

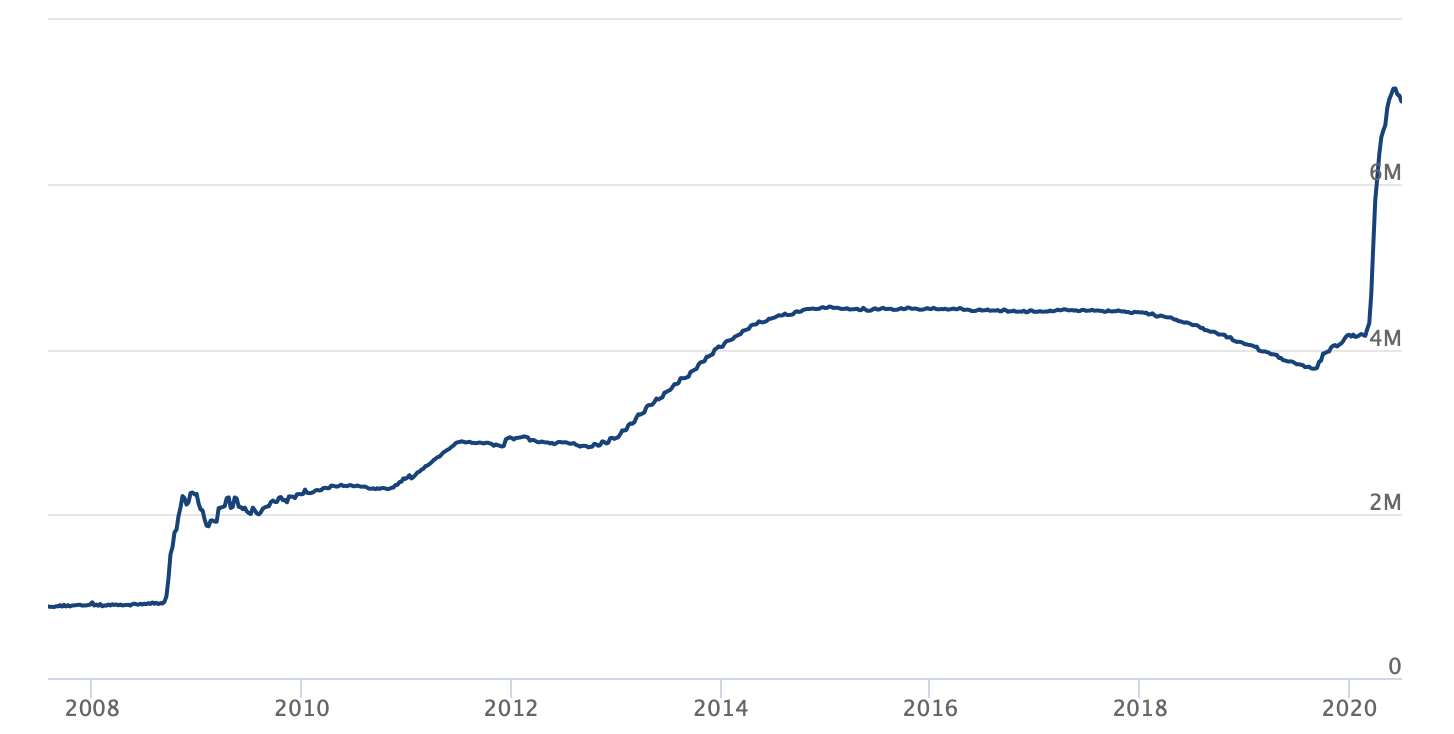

So if individual investors aren’t driving the market, then who is? Well, that leaves no other than our beloved government. Now, I’m sure most of you knew that the government has driven markets, but I feel their impact is severely understated. The Federal Reserve’s balance sheet has now ballooned to $7 trillion in assets, a $3 trillion increase in the span of five months. Through an unlimited bond-buying program, they’ve purchased everything from top of the line corporate bonds to absolute junk bonds. They’ve also increased repo market operations, pledging to inject a trillion dollars a week if need be. On top of all of this, they’ve created new emergency lending programs, some of which, as aforementioned, scoop up municipal bonds and corporate debt.

Federal Reserve’s Total Assets in Millions of Dollars

This interview with Ray Dalio is a great watch and I highly recommend it if you have the time. In one part of the interview, Dalio explains how capital markets are no longer free markets. He says, “Today the economy and the markets are driven by the central banks and the coordination with the central government." If we look at the 2008 crisis, banks were systemically important at that time and they were facing bankruptcy, so they were the ones that needed to be protected. But with the current situation, it’s much broader and the whole economy is systemically important. If the Federal Reserve does not lend to companies or buy corporate debt, we would lose large parts of our economy, which is why they are buying exorbitant amounts of bonds that would normally be foolish and setting interest rates to near zero. These are now markets which are driven by the central bank’s actions. But, “their desire to be an owner of those assets and their priorities about that ownership, when they buy and when they sell, are not the same as the classic free-market allocations.” These are assets being owned because of a dire situation and an extreme need to and as a result, the capital markets are not free markets allocating resources in traditional ways.

With all of this government stimulus, speculators now have the confidence to put money into stocks. Why wouldn’t they? The markets are going up and they don’t seem to be looking back any time soon. But, I think this is a big mistake. After the massive amounts of government stimulus allowed for a solid rebound, the market continued to rise, and this is where my skepticism lies. After the rebound from March lows, the market continued to, and continues to, rise on a positive investor outlook for the future. But these increases are based on a fundamental assumption: everything from this point on will be perfect. The stock market is commonly seen as a forward-looking mechanism since investors are looking to predict future outcomes and take action based on that. With the way the market is currently priced, the assumption is that there will be no second wave, a vaccine will be here by the end of this year/early next year, unemployment will decrease steadily, etc. The chances of a perfect recovery are very unlikely, and we’ve seen this happen already. When there were worries of a second wave, the S&P 500 quickly shed a little less than 200 points in one day, which is a sharp drop. Because of how the market is propped up on these unreasonable assumptions, even the smallest hiccup leads to large levels of volatility.

The coronavirus situation has ushered in a new age of speculators who previously never knew what a P/E ratio was. I love to see people trying new things, but I think this current market environment is simply too risky and volatile for beginners. Especially with the developments of apps like Robinhood which aim to simplify investing, I personally believe that these apps oversimplify investing to make it seem like something you can learn overnight. I have no problem with someone making an investment decision based on sound reasoning through research. But it becomes a problem when people start to buy without putting in any time to learn about a company. The reason I’ve been using “speculation,” throughout this blog is because this new age of investing is not real investing: it’s all speculation. People are putting money into stocks because of certain market trends without doing any research. The father of value investing, Benjamin Graham, goes into detail on the differences between investing and speculating in his book The Intelligent Investor. The bottom line is that speculation is basically the same as gambling, and that’s what a lot of people are doing right now. How else would a company on the brink of bankruptcy attempt to sell $1 billion in stock?? (*cough cough* Hertz *cough cough*)

As Leon Cooperman said, the speculation by Robinhood traders in stocks such as airlines will, “end in tears." It’s going to be very interesting to see how markets act in the coming months considering we’ve never been in a situation like this. But no matter what happens, as per usual, we’ll all look back on these times in the future and say to ourselves, “I’m so stupid, I obviously should have bought at that point!” No, it wasn’t obvious. No one knew what was going to happen. No one knows what is going to happen.

Disclaimer: I am by NO MEANS an expert in stock trading. I’ve just included my opinions here based on what I’ve been reading. You can listen to what I’ve said to make decisions of your own if you feel they are valid, but I am not responsible for any losses.

Close

space: it's more than an endless abyss

7/22/20 - FOUR MINUTE READ

Space. The final frontier. A never ending abyss. It’s easy to feel small when you look up at the sky and realize how vast space truly is. The closest star, Alpha Centauri, is 4.3 light years away. With current technology, it would take us at least 18,000 years to get there. And that’s after making a lot of assumptions. I’ve always had a passion for space. I never loved it enough to pursue it as a career, but I can find myself getting lost in hours of Youtube videos on anything space related. Its incomprehensible vastness coupled with its many mysteries leads to endless possibilities on where we can go and what we can accomplish. Though we’re years away from warp drive or even getting humans to the outskirts of our solar system, we are making significant developments in our part of the neighborhood. We’ve made some significant headway in the past decade in low Earth orbit that is going to lead to some big changes in coming years.

If you were asked what the next big thing is, what would you say? Maybe machine learning? Blockchain? Self driving cars? Space may not be the first option to come to mind, but I firmly believe that investing in space is going to lead to the most significant developments in coming years. It’s been nearly a half century since humans last set foot on the moon, and during that time, we’ve focused mainly on low orbit and unmanned space exploration missions. But, we are now in an exciting time in terms of space investment. High levels of private funding and advances in technology are revamping humans’ love for space.

For the first time in nearly ten years, astronauts traveled to space from US soil. It was a beautiful spectacle. I still remember watching shuttle launches and spacewalks as a kid and hoping to one day be an astronaut. Watching astronauts launch from US soil after so long was truly moving and quite emotional to say the least. But, it was different this time. This time, NASA let SpaceX take full control. It was a pivotal moment in human spaceflight. If anything went wrong, it could have tainted both NASA and SpaceX’s images in unimaginable ways. The NASA/SpaceX partnership is the first public/private partnership in the history of human spaceflight, and its impact will be profound on the future of space travel.

NASA’s Commercial Crew Program is working with SpaceX and Boeing to develop a U.S. transportation capability to and from the space station and other destinations in low-Earth orbit. “Commercial transportation to and from the station will provide expanded utility, additional research time and broader opportunities for discovery on the orbiting laboratory,” according to NASA. Partnerships have been key to NASA’s success in the past, ranging from rockets to satellites to universities offering their brightest minds. But they have never given full control to a private entity, until now. SpaceX began resupplying to the International Space Station around two years after the final shuttle mission with the Dragon and their Falcon 9 rockets. After many successful trips, NASA finally decided to let SpaceX send humans to the ISS. And it worked flawlessly.

This is huge. This achievement has now opened doors for commercial spaceflight that previously were not possible. The agency has now adopted a five part plan to enable a thriving economy in low Earth orbit. This includes adopting new policies that allow for some commercial activities, creating new opportunities for private astronaut missions, and pursuing activities that foster new and emerging markets. These initiatives not only keep the space station functional, but they now help space programs all over the world as it creates new opportunities for private companies to gain exposure in growing economies.

One revolutionary technology can spark new eras of modernization and innovations. Just look at the Internet: it allowed for a new age of connection throughout the world and allowed people to achieve feats that were previously impossible. The Internet enabled regular people to become CEOs of Fortune 500 companies, avid gamers, and everything in between. Reusable rockets may have the same effect. Morgan Stanley equity analyst Adam Jonas says, “Just as further innovation in elevator construction was required before today's skyscrapers could dot the skyline, so too will opportunities in space mature because of access and falling launch costs.”

There is no set number, but reusable rockets are estimated to have the potential to save around $10 to $15 million per launch. More than cost saving, reusable rockets are huge for increasing the volume of spaceflights. For SpaceX to reach a strong positive cash flow, they will need more than the 10-12 traditional launches per year. From a production and logistics standpoint, reusable rockets will allow for SpaceX to nearly double their flights in a year. The potential to double the number of flights in one year is amazing. Imagine all of the opportunities that would open up. There would be more flights to the ISS, more satellite launches, and more ability for space exploration.

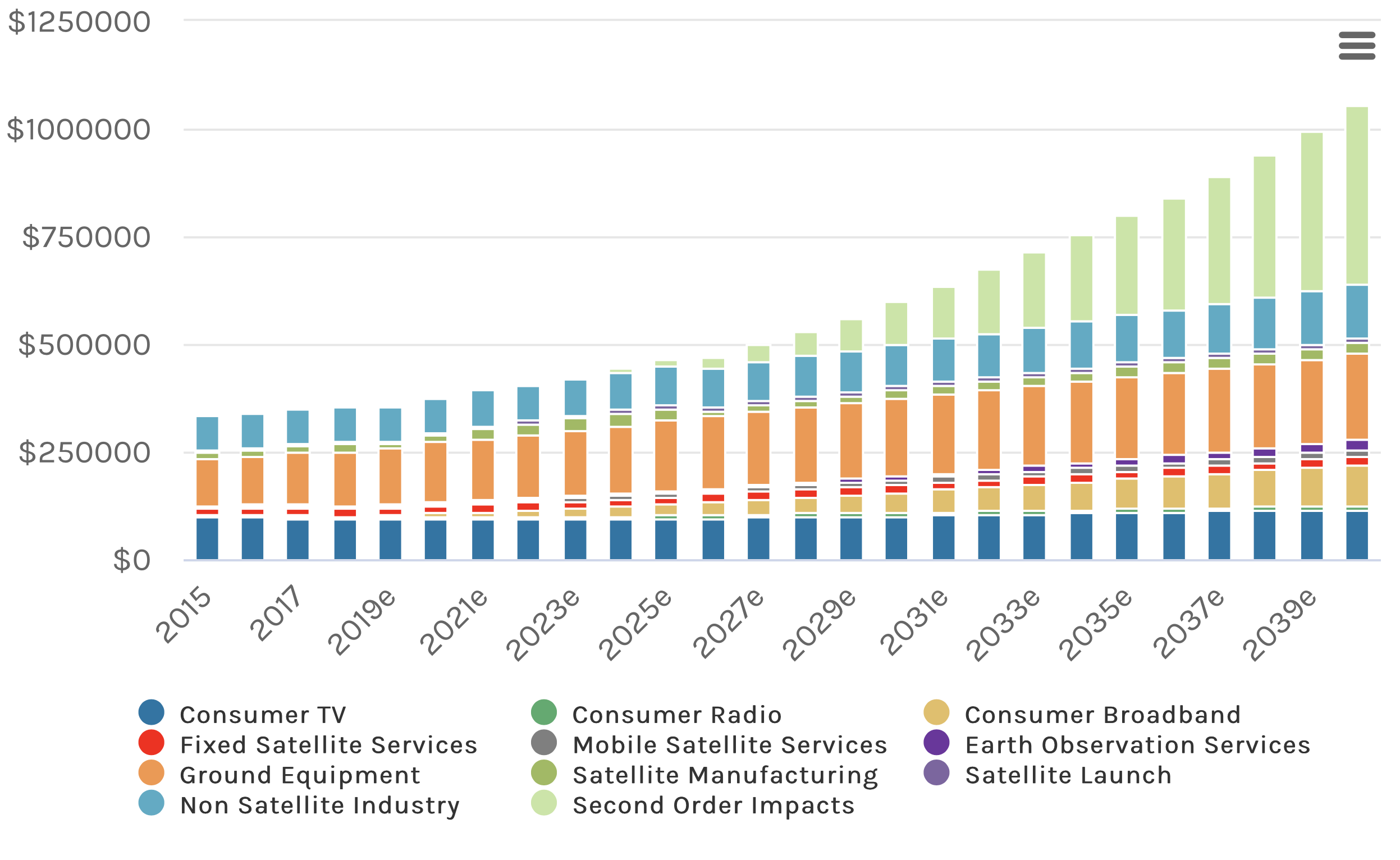

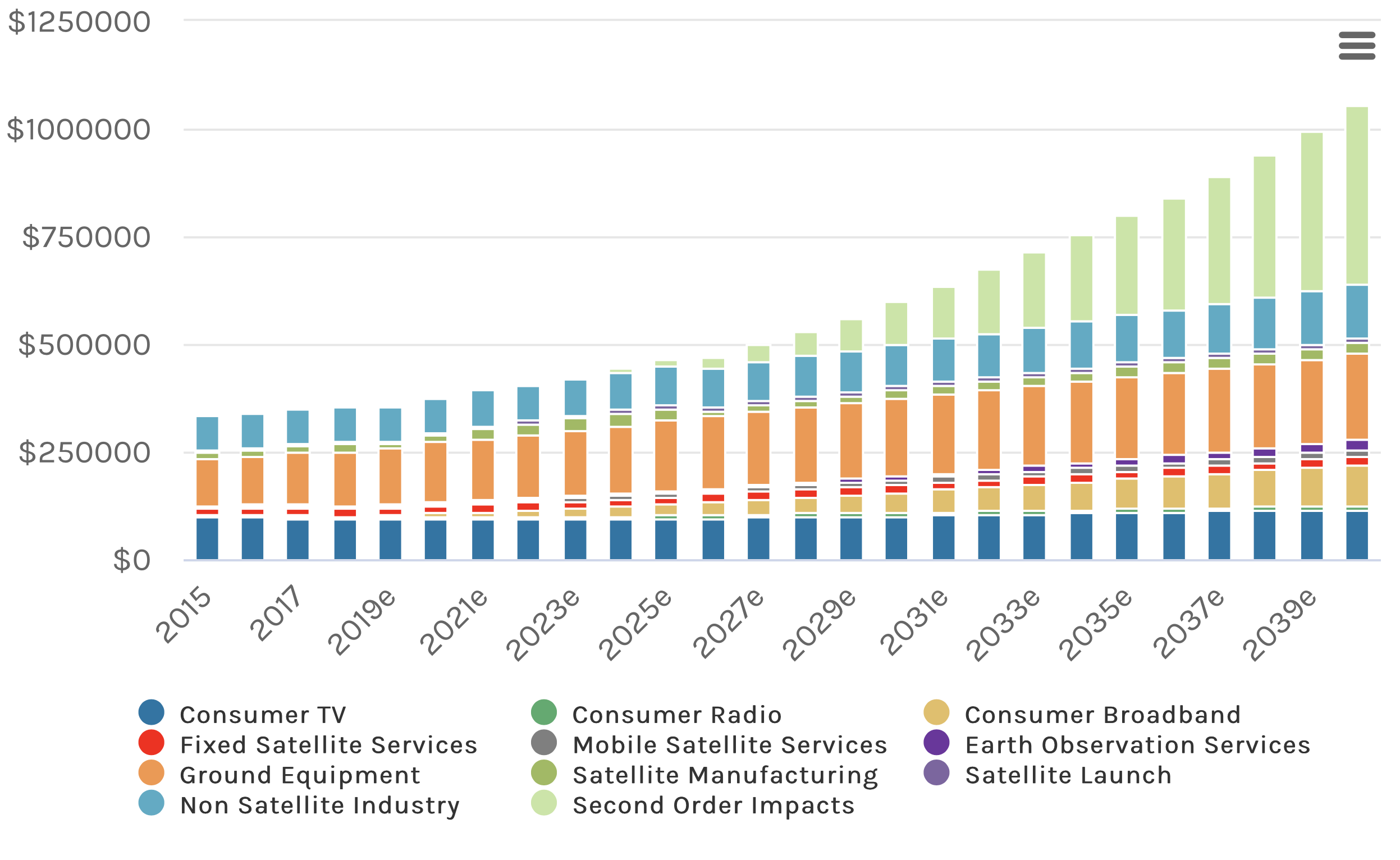

Near term, investment in space will most likely impact industries beyond just aerospace and defense, like IT hardware and telecom. Morgan Stanley estimates that revenue generated by the global space industry can reach up to $1 trillion by 2040, up from $350 billion currently.

The most significant short and medium term opportunities will most likely arise from satellite broadband Internet access. This is what we see happening with projects like Starlink from SpaceX, which seeks to deliver high speed Internet access to the most remote parts of the world.

Beyond opportunities generated by satellites, the new frontiers in rocketry offer some other interesting possibilities. Packages that are delivered by airplane or truck today could be delivered by rockets much faster. Private space travel could become commercially available, allowing people to travel across the world in a few hours. Mining equipment could be sent to autonomously extract minerals from asteroids.

Most investors nowadays either want to make a quick buck through day trading or are in for the long run, and choose stocks as their go to investment. But a more overlooked investment opportunity definitely lies in space. Initiatives by large public and private entities suggest that space is an area where we will see significant development. Investing in space will not only allow us to learn more about space itself, but it opens possibilities to enhance technological leadership, address vulnerabilities in surveillance, and further develop our understanding of up and coming fields like artificial intelligence.

Space is seen as a common ground of peace. With the Outer Space Treaty, space will always remain a violence-free frontier. When you look up at the night sky, you can rest assured that you won’t see weapons of mass destruction or two countries going to war. If we invest in space, we’re investing in a stronger, safer, and brighter future.

Close

my quarantine reading list

8/5/20 - FOUR MINUTE READ

The reason I started this blog was to share the knowledge I gain from reading. Since the start of quarantine I’ve read a solid amount of books, so today I want to share my whole quarantine reading list (books I’ve read from early April), and highlight my top five in no particular order. I’ll include the whole list at the end of this blog.

1. Deep Work by Cal Newport: I know I said this list is in no particular order, but this might be my favorite book. Deep Work single handedly transformed the way I organize my day and my life. In this relatively short book, Newport explains a system for doing work that he describes as, “the ability to focus without distraction on a cognitively demanding task.” It’s such a simple idea, but it’s so effective. When we look at how we have been wired in this digital age, we are so used to constantly being connected and becoming distracted by meaningless notifications. By setting everything aside for a period of time and working solely on one task with all of our focus, we are able to accomplish so much more in much less time. What I really love about this book is that rather than bashing on distraction, Newport focuses much more on the power of focus. The book is divided into two parts: in the first part he explains why deep work is so effective and how it can produce massive benefits, and in the second part he walks the reader through how to implement deep work in their life. As I said before, this book single handedly changed how I go about doing my work and managing my time. Like I highlighted in my first blog post, I was victim to the distractions of the devices around me, preventing me from finishing any work. After reading this book, I realized how important of a skill this would be to have, so I started implementing it. My work days quickly went from 12 hours to around 5-6 hours. This idea not only allowed me to finish more work in less time, but it changed how I structure my whole life. I now have much more time to do things that I truly enjoy, like reading, spending time with friends, and learning new things (I recently painted my whole garage), all while avoiding burning myself out. This book is a STRONG read for me, and I would recommend it to anyone who feels like they have a difficult time organizing their days or getting their work done efficiently.

2. Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World by Don and Alex Tapscott: Most everyone knows about Bitcoin, the cryptocurrency that gained rapid popularity as it peaked at nearly $20,000 in late 2017. Since then, Bitcoin has remained volatile when compared to traditional securities. Bitcoin itself was already a radical idea when Satoshi Nakomoto introduced it in 2008: a digital currency devoid of government control was completely unheard of at the time. But more than the currency itself, the technology behind it is the real game changer. Right now if you need to purchase something, chances are there is a middleman. If you’re buying groceries, the seemingly instantaneous and simple transaction has around five middlemen: card associations, merchant account providers, payment processors, payment gateways, and payment facilitators. Not so simple of a transaction right? But this is just one example, middlemen exist everywhere. From loans at banks to musicians being paid through record labels, there is most always a middleman when it comes to monetary transactions. Blockchain seeks to disrupt this by getting rid of the middleman and allowing two parties to deal directly with each other. This may seem like a simple concept, but its implications are huge. In this book, the Tapscotts get into the details of how blockchain has the potential to impact the world as we know it, from transforming how financial aid is delivered to developing countries to changing how we vote. What I love about this book is rather than focusing too much on the nitty gritty of how blockchain works, it highlights more of the economic implications of the technology and the main principles upon which the technology was created. This is definitely a book I recommend to anyone who wants to understand the impacts of a disruptive technology that is on the rise. If you want to learn the specific details of how blockchain works, I recommend Blockchain Basics: A Non-Technical Introduction in 25 Steps, which explains how the whole blockchain works and is explained in a very simple way to understand through comparisons to everyday concepts.

3. Supermarket by Logic: I’m not the most avid reader of fiction books, but this book from rapper Logic is probably one of my favorite novels. This is the only fiction book I read during quarantine, and I must say I’m glad this is the one I chose. With the official genre listed as “psychological thriller,” the book starts off pretty slow with main character Flynn, an aspiring author, taking a job at a local supermarket to gain inspiration for his next book. But as the book continues, the reader is presented with riveting plot twists and as everything unfolds, you look back and realize small things you didn’t realize before. This book had me at the edge of my seat, leading me to finish it in one sitting. It’s also not that long of a book, Logic keeps things succinct and doesn’t run the book on for too long. This is definitely one of my favorite novels that I’ve read, and I’d recommend it to anyone looking for a quick, exciting, and entertaining read.

4. Winner’s Dream: A Journey from Corner Store to Corner Office by Bill McDermott: In this autobiography by ex-SAP CEO and current ServiceNow CEO, Bill McDermott walks the reader through his whole life, from his humble beginnings in Amityville, New York to his top position at one of the most prominent ERP companies in the world. This is your typical autobiography, but what stood out to me in this book was the overall message. McDermott walks us through his multiple experiences in business from starting his own shop to his long standing position at Xerox. Through all of his positions, he seems to have a way of attracting people and bringing out the best in them, leading to his successful track record that we see today (he has nearly doubled ServiceNow’s stock price in less than a year). The reason this is one of my favorite books that I read this quarantine is because of the underlying human aspect. Many autobiographies that I’ve read tend to simply walk through a person’s life, highlighting their achievements and their journey, which I have no problem with. But in this book, McDermott really highlights why he does what he does and how different experiences transformed him. Through the book, it is so interesting to see how he grew over time, and when I read it, it felt like I was reading the autobiography of a friend. The trait that brought him all of his success, charisma, shines through in this book and made it one of the more memorable ones I read during this quarantine. I would recommend this for anyone who is a fan of autobiographies, or for anyone who wants to understand how to succeed in the workplace through connection with people on a deeper level rather than simply “colleagues."

5. Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor by John Bogle: This book by legendary investor John Bogle guides the reader through his advice on investing in mutual funds. Sticking to his most well known mandates such as staying the course and keeping costs low, Bogle shows the reader all of the important factors to consider when investing in mutual funds. Before reading this book, all I knew about mutual funds was that they were a collection of different securities that were managed by someone else, and that you can put money into them for a fee. This book changed my outlook on investing. Let’s be honest, telling your friends that you invested in the next Tesla or Amazon is way more exciting than telling them you put your money into the Vanguard S&P 500 ETF. But it has been proven time and again that the majority of hedge funds do not beat market returns. It’s very hard to get the diversification benefits at the low costs that an index fund presents. Yes it’s not as exciting, but I wouldn't bet against America when it comes to investing. This is a great read for anyone who wants to start investing, but may not want to put their money into individual stocks and would prefer someone else work with their money. It’s also a great introduction to mutual funds. Fair warning, this is the longest book on this list, so if you’re not a fan of reading a 500+ page book, this may not be the one for you.

Well, those are my five favorite books from this quarantine. In three months, I’ve read a total of 27 books, so it wasn’t too easy picking my five favorites considering all of the books I read were interesting. Below, I’ll include the titles of all of the books I read in case you’re interested.

Full reading list:

1. Digital Minimalism 2. Deep Work 3. Machine, Platform, Crowd: Harnessing our Digital Future 4. Supermarket 5. The Intelligent Investor 6. Quick Thinking on Your Feet: The Art of Thriving Under Pressure 7. How to Win at College 8. Blockchain Basics: A Non-Technical Introduction in 25 Steps 9. Winner’s Dream: A Journey from Corner Store to Corner Office 10. Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World 11. Prediction Machines: The Simple Economics of Artificial Intelligence 12. Coined 13. The Curse of Cash: How Large-Denomination Bills Aid Crime and Tax Evasion and Constrain Monetary Policy 14. Essentialism: The Disciplined Pursuit of Less 15. Enough: True Measures of Money, Business, and Life 16. The Money Hackers: How a Group of Misfits Took on Wall Street and Changed Finance Forever 17. Outliers 18. The Tipping Point: How Little Things Can Make a Big Difference 19. Blink: The Power of Thinking Without Thinking 20. The Big Short: Inside the Doomsday Machine 21. How Google Works 22. Astrophysics for People in a Hurry 23. Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money 24. Disrupt Yourself: Putting the Power of Disruptive Innovation to Work 25. The 4-Hour Workweek 26. The Economics of Inequality 27. Saving Capitalism: For the Many, Not the Few

Close

disciplined pursuit of less

8/19/20 - FOUR MINUTE READ

A few weeks ago, I wrote a blog about increasing productivity, and one of the strategies that I presented was the idea of choosing fewer tasks to take on at once, and focusing deeply on those. What I did not realize was that this idea had a formal name to it: essentialism. Essentialism is more than a concept: it is a way of thinking. It comes down to, “Am I investing in the right activities?” When one becomes an essentialist, “I have to,” becomes “I choose to.” When one becomes an essentialist, “It’s all important,” becomes “Only a few things really matter.” When one becomes an essentialist, “I can do both,” becomes “I can do anything, but not everything.”

Essentialism by Greg McKeown was a very intriguing read that opened my mind to a completely new way of thinking. Like I mentioned previously, I have always been a strong supporter of focusing on a few things and completing them with all of your effort, but what I didn’t realize was that this concept of essentialism goes much deeper than this. Essentialism applies to everything that we do in our lives. Anything that entails a choice can benefit from the principles of essentialism. We are faced with so many choices in our everyday lives, but employing a sort of filter when making these decisions will allow us to take on only the most valuable tasks. Strategies like “If it’s not a clear yes, then it’s a no,” are great ways to determine whether something is truly worth taking on or not.

The concept of essentialism boils down to prioritizing yourself over the needs and wants of others. A big part of this is being unavailable. What I mean by this is valuing yourself enough to separate your work and personal life. With the digital age we live in, the line between time for work and time with family has become stretched very thin, and this has only been accelerated and worsened by the coronavirus. It is now very easy for us to check an email at 8 PM and respond to it or hop on a call at odd hours. It feels much harder nowadays to find a proper work/life balance, and a large part of that is because of how technology has diffused throughout our society and become the center-point of many businesses. However, there is an easy way to bypass this: simply become unavailable. See, if at work or in school, you become known as that person who is “old reliable,” and you can always be counted on to answer a question or take on a project, then people will always be approaching you. That’s the reputation you’ve built for yourself. This is not necessarily a bad reputation to have, but it makes it much harder to be unavailable when you’re constantly working.

This is why you need to have barriers in your life, physical and virtual. Examples of physical barriers include breaks, times when you’re away from work, and being able to say “no” in situations. Virtual barriers come in all forms, but some examples include an automatic response to emails after a certain time letting people know you’re away, checking emails much less frequently, and not always watching your phone. When you start to implement barriers in your life, you will begin to realize that people will become much less reliant on you and will undertake more tasks by themselves. This not only allows you to now focus on what matters most to you, but it gives you much more time to use how you please, whether that be focusing on more work or taking time away from work.

At the end of the day, you need to figure out what really matters to you: do you want to be seen as the coworker that everyone loves, or are you willing to take a hit on your persona to be much happier? This also presents another key aspect of essentialism, which is the trade-off. I love how McKeown positions trade-offs in this book: “We can try to avoid the reality of trade-offs, but we can’t escape them.” This perfectly encapsulates the scenario that so many people are faced with today. People try to avoid the reality of trade-offs by taking on multiple tasks at once. They feel that by doing more, they are accomplishing more and that they don’t have to worry about sacrificing anything. But the reality of the situation is that they do more harm by taking this route. You can save yourself a lot of pain and trouble by making a sacrifice before starting something than when you’re already halfway done doing something and realizing you have to give it up. In the moment, you may feel like you lost something or are missing out on a great opportunity. But, if you weigh your options properly and understand what you will get out of a certain opportunity, there is no need to feel regret in choosing one option over the other.

It’s all about small wins. Sure, you may be giving up a project that will get you CEO recognition now, but you’re now adding a new programming language into your arsenal that will allow you to pursue much more lucrative job positions down the line. The key to adopting an essentialism mindset is realizing that you can’t do everything. You can do anything, but you can’t do everything, and once you realize this you will be able to successfully prioritize tasks. The problem many of us face is that we take on too much, afraid to sacrifice and accept a small win that will have a huge impact in the future. When we have too much on our plate, down the line, we are not able to handle it all. But, since we’ve invested so much time and effort (and maybe even money), we refuse to give up and want to see it through to the end.

This issue that leads us into a self perpetuating downward cycle of unproductiveness and immense time waste is called the sunk-cost bias. The sunk-cost bias is the idea that we continue to invest time, money, or effort into something that we have already started, but we know is a losing proposition, because we have already incurred a cost that we can’t recoup. We’ve all experienced the sunk-cost bias, but the power of being able to get out of it, to finally give up and realize that it’s not worth it to continue the given task at hand, is invaluable. Try to think of a time the sunk-cost bias happened to you, and imagine how much time and effort you could have saved if you simply gave up. I’m not one to give up on a task easily, but being able to realize when to give up and when to continue persevering is an extremely valuable skill to have.

Before I end this blog, I want to highlight that it can be very easy to confuse essentialism and minimalism. The difference between these two concepts is very fine, so it’s hard to tell at times which is which. At the end of the day, the interpretation is up to you as to what the difference is, but for me, it comes down to how one makes a decision in their life regarding something. A minimalist will attempt to lessen clutter, but can tend to keep things that bring them joy. An essentialist, on the other hand, will only keep what is of utmost importance to continue their life. For example, a minimalist may switch to electronic books, or may buy books and then donate the ones they don’t re-read afterwards, while a minimalist may simply keep a library card. I believe that essentialism is a subset of minimalism, but a more extreme version at that.

Essentialism is so much more than just making a choice. It’s about loving and prioritizing yourself over the expectations of others. It’s about understanding the nature of trade-offs and positioning yourself in such a way now for success in the future. It’s about focusing on what truly matters to you. These aren’t changes that come about overnight, but through habitual and conscientious adjustments in your daily life, over time you will begin to adopt an essentialist lifestyle.

Close

Elements

Text

This is bold and this is strong. This is italic and this is emphasized.

This is superscript text and this is subscript text.

This is underlined and this is code: for (;;) { ... }. Finally, this is a link.

Heading Level 2

Heading Level 3

Heading Level 4

Heading Level 5

Heading Level 6

Blockquote

Fringilla nisl. Donec accumsan interdum nisi, quis tincidunt felis sagittis eget tempus euismod. Vestibulum ante ipsum primis in faucibus vestibulum. Blandit adipiscing eu felis iaculis volutpat ac adipiscing accumsan faucibus. Vestibulum ante ipsum primis in faucibus lorem ipsum dolor sit amet nullam adipiscing eu felis.

Preformatted

i = 0;

while (!deck.isInOrder()) {

print 'Iteration ' + i;

deck.shuffle();

i++;

}

print 'It took ' + i + ' iterations to sort the deck.';

Lists

Unordered

- Dolor pulvinar etiam.

- Sagittis adipiscing.

- Felis enim feugiat.

Alternate

- Dolor pulvinar etiam.

- Sagittis adipiscing.

- Felis enim feugiat.

Ordered

- Dolor pulvinar etiam.

- Etiam vel felis viverra.

- Felis enim feugiat.

- Dolor pulvinar etiam.

- Etiam vel felis lorem.

- Felis enim et feugiat.

Icons

Actions

Table

Default

| Name |

Description |

Price |

| Item One |

Ante turpis integer aliquet porttitor. |

29.99 |

| Item Two |

Vis ac commodo adipiscing arcu aliquet. |

19.99 |

| Item Three |

Morbi faucibus arcu accumsan lorem. |

29.99 |

| Item Four |

Vitae integer tempus condimentum. |

19.99 |

| Item Five |

Ante turpis integer aliquet porttitor. |

29.99 |

|

100.00 |

Alternate

| Name |

Description |

Price |

| Item One |

Ante turpis integer aliquet porttitor. |

29.99 |

| Item Two |

Vis ac commodo adipiscing arcu aliquet. |

19.99 |

| Item Three |

Morbi faucibus arcu accumsan lorem. |

29.99 |

| Item Four |

Vitae integer tempus condimentum. |

19.99 |

| Item Five |

Ante turpis integer aliquet porttitor. |

29.99 |

|

100.00 |

Close